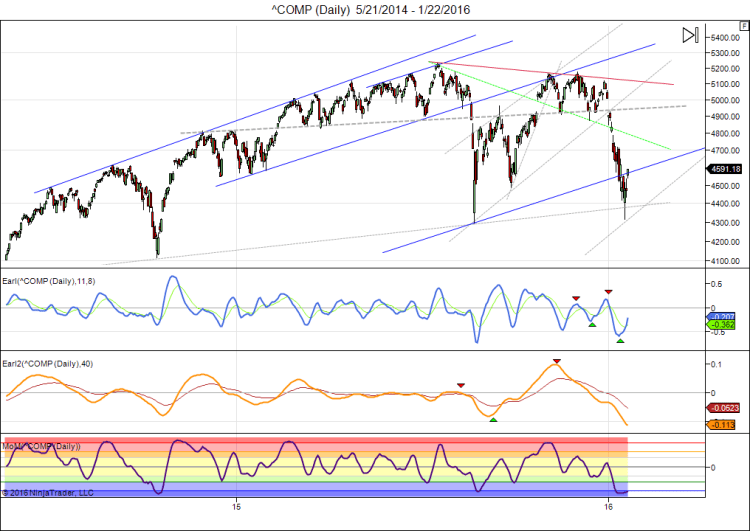

Not unexpectedly, stock markets rebounded in the second half of the week. It wouldn’t surprise me if this rebound continues well into February, and then the next question will become whether the January lows will be revisited or not. That’s just the market taking the path of max confusion, as it likes to do. Taking a look at the current Nasdaq chart:

The August lows have held in this index. That’s a plus. The Earl and MoM indicators have bottomed out and are headed higher. The slower Earl2 (orange line) is still going down. An extreme low is going to be set in the Earl2. This may mark a major bottom in the market, but a second lower low remains possible, potentially painting a bullish divergence in the Earl2 some time this spring. So, this is not a time to become aggressively bullish already. As can be noticed in the weekly reversal levels, it will take more healing until we can become sufficiently confident that the correction is over.

On a longer term chart this market is in a large sideways since late 2014. And it could very well be that we have to wait until summer to see which way it goes next. Given the widespread pessimism at the start of the year I think the next major move will be up, surprising many. That’s why we may have bottomed last week.