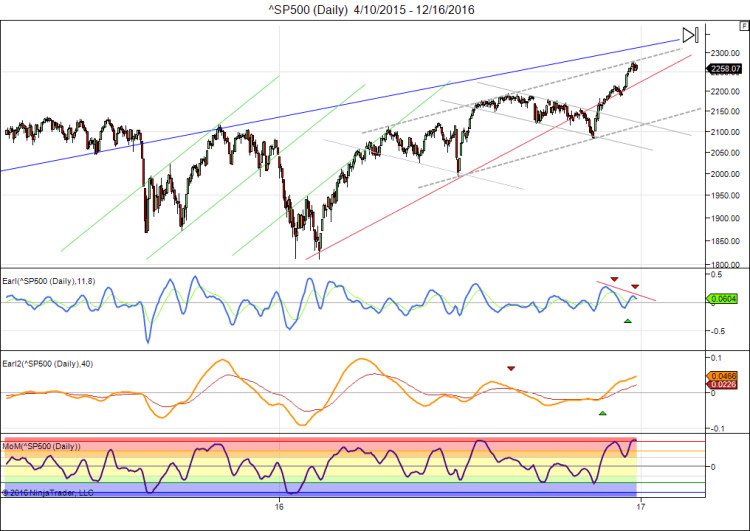

Markets had a fairly flat week and a few attempts to push the Dow above 20k have come up short. The recent lunar red period ended with a 181 point gain for the Nasdaq and we are now starting a new green period. That would normally get us above 20k, but the green periods have been weak all year so that isn’t helping much. Let’s have a look at the S&P 500:

This index is bumping into a few overhead resistance lines. There is also a bearish divergence appearing in my Earl indicator (blue line), which is an early warning sign. The slower Earl2 (orange line) keeps going up, but may be nearing a top as well. The MoM indicator is still in the +8 very optimistic zone.

All in all the lunar green period and the slower year-end trading could be enough to push the S&P to 2300 and the Dow above 20k. But that is not a given and would probably be followed by a slow start in 2017.

A choppy market for the rest of the year would be healthier. Stocks could catch some breath and that would give us a nice setup going into January.

I don’t know what will happen, but with most of my indicators looking rather stretched I am going to trade cautiously until those readings come down to more neutral levels.