-

Outlook for world markets with our comments for next week. If you have any trouble to see the presentation below, then click here. Click the “Expand” button (bottom right) to watch in full screen mode. * The latest weekly reversal levels for over 2500 stocks and ETF can be found every weekend at http://www.reversallevels.com/. *

-

Not unexpectedly, stock markets rebounded in the second half of the week. It wouldn’t surprise me if this rebound continues well into February, and then the next question will become whether the January lows will be revisited or not. That’s just the market taking the path of max confusion, as it likes to do. Taking

-

Outlook for world markets with our comments for next week. If you have any trouble to see the presentation below, then click here. Click the “Expand” button (bottom right) to watch in full screen mode. * The latest weekly reversal levels for over 2500 stocks and ETF can be found every weekend at http://www.reversallevels.com/. *

-

Outlook for world markets with our comments for next week. If you have any trouble to see the presentation below, then click here. Click the “Expand” button (bottom right) to watch in full screen mode. * The latest weekly reversal levels for over 2500 stocks and ETF can be found every weekend at http://www.reversallevels.com/. *

-

Stock markets went into a steep slide last week, producing one of the worst starts to a new year ever. I wrote last week that the shorter term indications tend to pan out first, and that’s what we are getting. This gives us a new situation in the Nasdaq chart (click image to enlarge it):

-

Outlook for world markets with our comments for next week. If you have any trouble to see the presentation below, then click here. Click the “Expand” button (bottom right) to watch in full screen mode. * The latest weekly reversal levels for over 2500 stocks and ETF can be found every weekend at http://www.reversallevels.com/. *

-

In part 1 of this series I tried to explain why having a trading method is important. Somebody may have the body and the talent to be a top tennis player, but if he steps on the court without a clear game plan then he is not likely to win Wimbledon. An investor may have

-

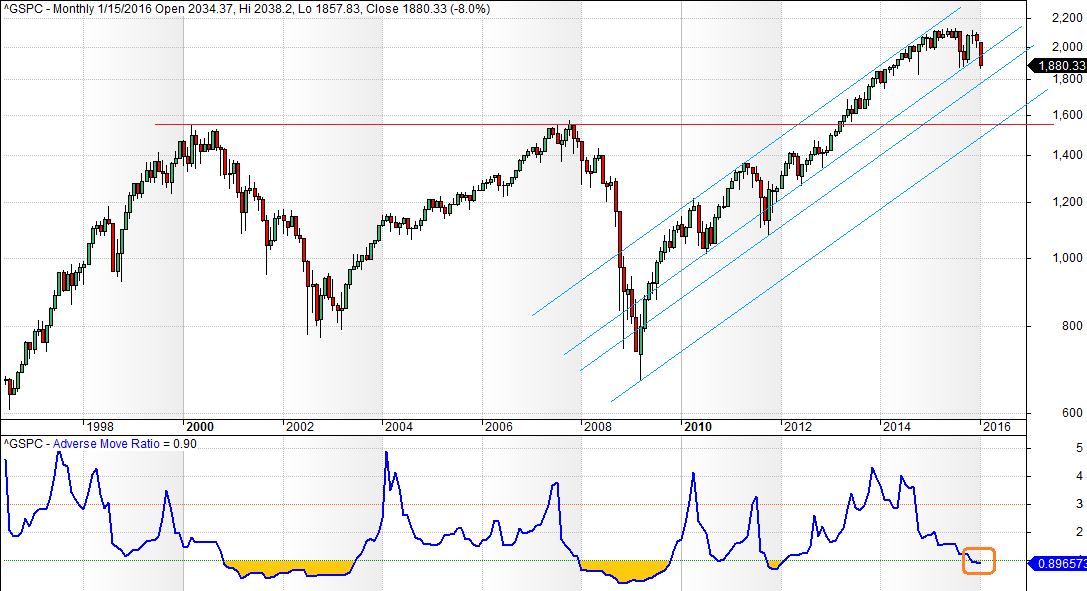

Stocks had a weak santa rally and the S&P 500 ended the yearly nearly unchanged. The S&P remains confined to the 2000-2100 range and the next major event is going to be when stocks break away from that range, up or down. Let’s have a look at the chart (click image to enlarge it): The

-

Outlook for world markets with our comments for next week. If you have any trouble to see the presentation below, then click here. Click the “Expand” button (bottom right) to watch in full screen mode. * The latest weekly reversal levels for over 2500 stocks and ETF can be found every weekend at http://www.reversallevels.com/. *

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.